When it comes to protecting your family with life insurance, many people turn to Whole Life policies for their unique features such as consistent, level premiums for life, the ability to accumulate cash value, and living benefits. Some Whole Life Policies are especially unique because they offer dividends back to the policyholder in addition to building cash value. This option is only offered through mutual life insurance companies. These companies are not owned by stockholders or private equity companies, instead, they are owned by the policyholders. Let’s explore the main features and discover if a Whole Life policy is the right fit for you.

Permanent Coverage

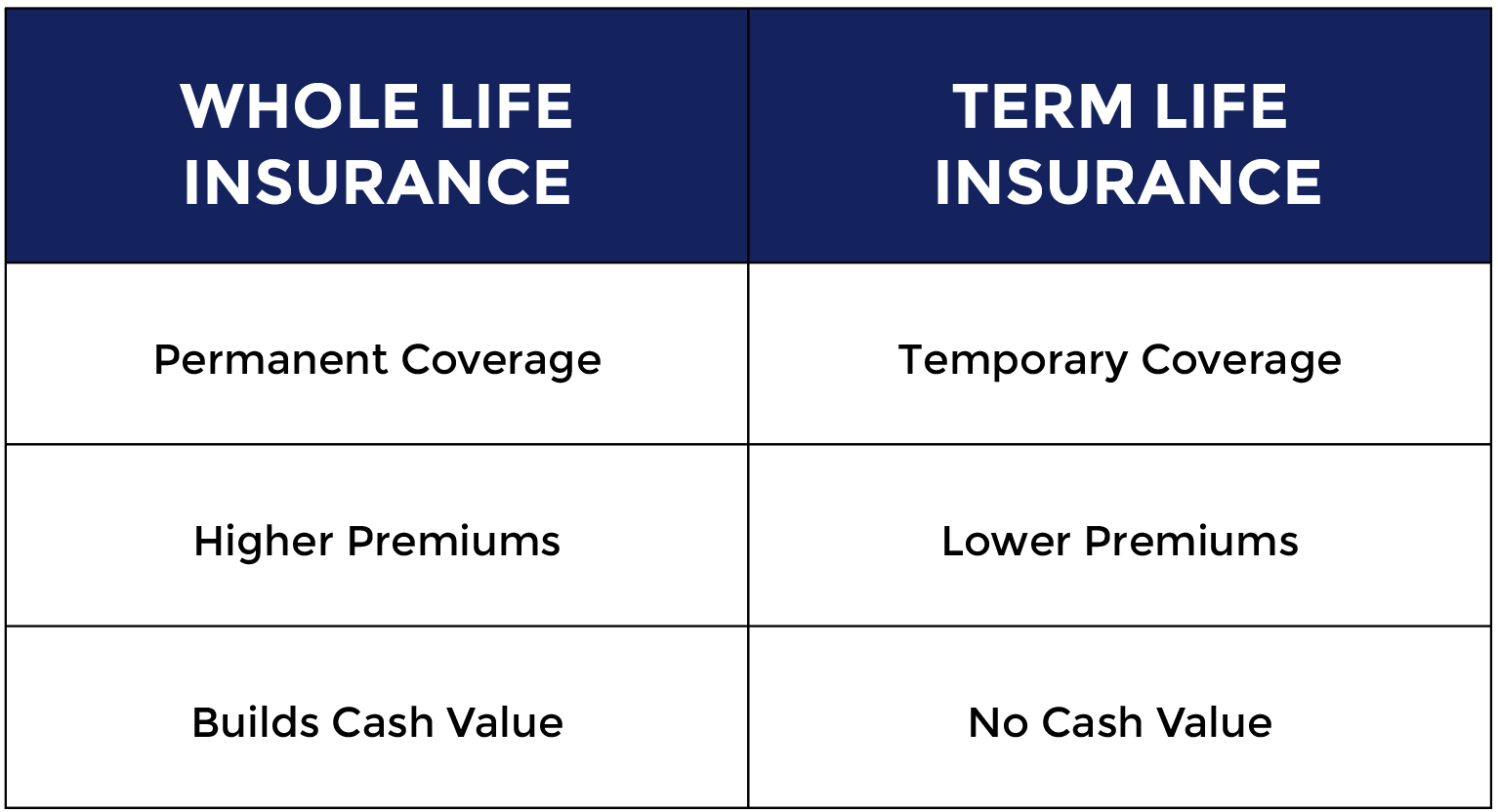

Whole Life insurance is a type of permanent life insurance. While premiums are paid, it provides coverage for your entire lifespan. Regardless of whether you pass away immediately after purchasing coverage or if you pass away 50 years later, your beneficiaries would receive the benefit.

Build Cash Value

In addition to consistent premiums, your policy can also accumulate cash value over time in the form of dividends. Mutual life insurance companies, such as MassMutual offered through United Benefits, operate for the benefit of their participating policy owners and members, and are managed with policy owners’ long-term interests in mind. Policy owners are eligible to receive an equitable portion of the company’s surplus, called divisible surplus, as a dividend each year. Dividends are not guaranteed; however, MassMutual has paid Whole Life policy dividends consistently since the 1860s. To learn more about the dividend history of Mass Mutual for the past 100 years click here.

Consistent Premiums

Whole Life premiums are set at issue based on your current age and will stay the same throughout your life. Contrast this with FEGLI (Federal Employee Group Life Insurance) that can increase in cost by over 650% by the time you retire! Most federal employees drop or greatly reduce their coverage at retirement because the deduction is too high. You can offset this risk by having a whole life policy with guaranteed premiums.

Simplified Issue

Perhaps best of all, as a federal employee, you are eligible for this policy with simplified issue guidelines. That means there are no health exams, bloodwork, or other requirements to qualify. As long as you are actively at work in federal service and can answer one health question, you can apply for coverage for you, your spouse, and even your children.

Could a Whole Life Policy be right for you? To apply for coverage, fill out the form below and a United Benefits Specialist will contact you for a one-on-one consultation.